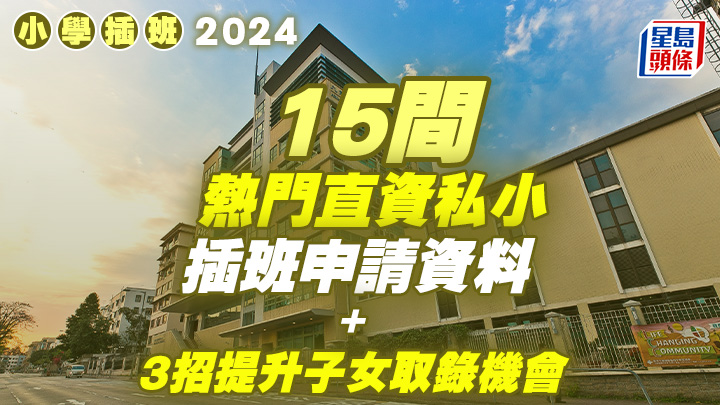

小學插班2024|15間熱門直資私小申請資料 + 3招提升子女取錄機會

2024-04-25 06:30

升中派位2024|即睇全港18區英中學額分布

2024-04-12 08:30

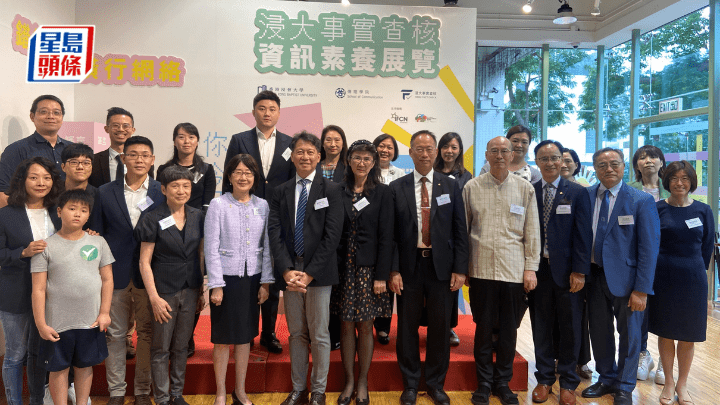

浸大傳理學院院長:毋須就假新聞立法

27分鐘前

DSE開考懶人包2024|核心科/選修科精讀備戰攻略 + 解構扣分/DQ陷阱 + 惡劣天氣安排

2024-04-03 06:30

我的紀律部隊夢|黃副校長隨筆

22小時前

牛頓運動定律 成就航天夢想|星島教室

22小時前

香港全民閱讀日|黃楚標中學辦聯校工作坊

23小時前

職訓局擬推新醫療課程 培訓牙齒衛生員

2024-04-25 10:54

親子有禮︳對抗敏感肌!送42套Cetaphil舒特膚益生元鎖水潔膚乳及潤膚乳液

2024-04-25 07:15

新一期《親子王》7-11及OK便利店有售!即睇更多升學教育、教養溝通資訊

2024-04-25 00:02

城大成立數碼醫學研究院 冀推動醫療創新

2024-04-25 00:00

深圳親子遊2024︳深圳宇宙迷航兒童遊樂場低至$35任玩 超巨型室內遊樂場必玩旋轉滑梯/波波池海

2024-04-24 17:35