佛教沈香林紀念中學 善用知識管理 促進自主學習

10小時前

「生成式人工智能科」將列入嶺大一年級生必修科

11小時前

速食快餐飲食文化 學生字

11小時前

城大獲准設立東莞分校 聚焦AI及數據科學等領域

12小時前

曹春生 - 盡信書,不如無書|學友智庫

15小時前

DSE歷史科2024|拆解卷一資料題+卷二論述題

22小時前

英語教室︳10個自學英文方法推介 玩Facebook、IG有幫助 附推介學英文網站

2024-04-18 21:47

親子健康︳「唔食嘢」或生痱滋?幼兒生痱滋好普通? 小朋友有一情況或出現脫水應即求醫!

2024-04-18 21:41

親子優惠︳兒童圖書開倉過萬本圖書低至6折全場$7起 必掃$10特價區、即睇抵買推介

2024-04-18 18:34

Philips飛利浦開倉低至3折!抽濕機/空氣清新機/氣炸鍋/電飯煲/LED燈膽最平$39起 附半年原廠保養+3大購物優惠

2024-04-18 17:33

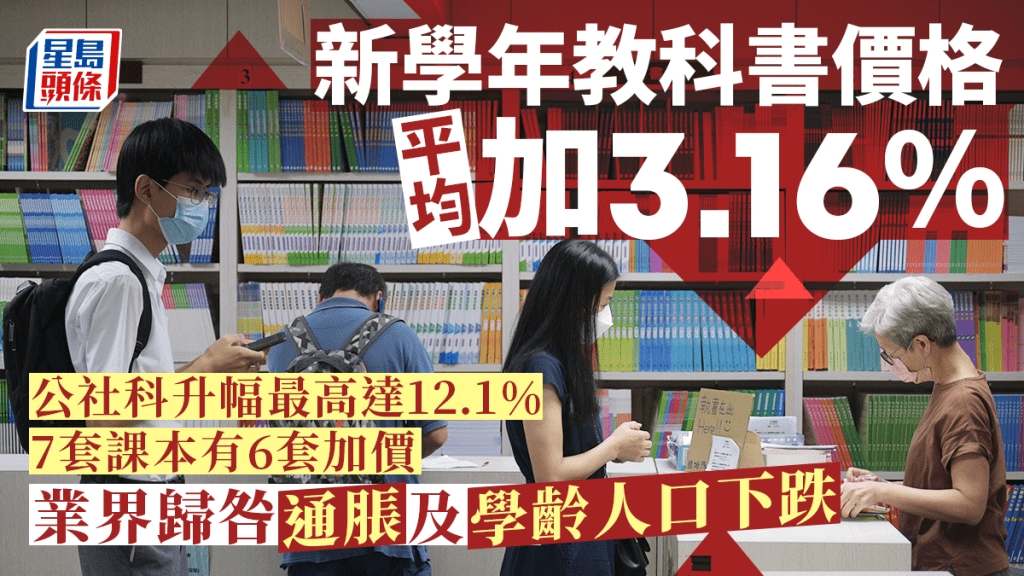

新學年教科書價格平均加3.16% 公民科課本減價戰落幕 升幅最高12.1%

2024-04-18 17:16

百家姓「顧」源於姒姓 為這個王的後裔?|姓氏知多啲

2024-04-18 15:49