升中派位2024|即睇全港18區英中學額分布

2024-04-12 08:30

公主病與王子病 |黃副校長隨筆

2小時前

DSE開考懶人包2024|核心科/選修科精讀備戰攻略 + 解構扣分/DQ陷阱 + 惡劣天氣安排

2024-04-03 06:30

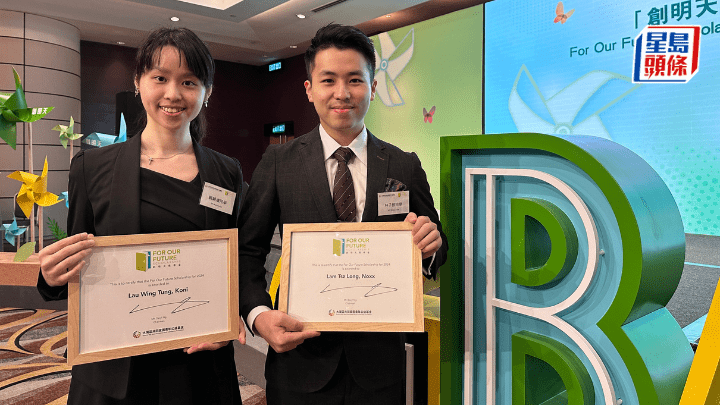

16名優秀大學生 獲頒「創明天獎學金」

4小時前

張沛松紀念中學《北京考察交流之旅》 從歷史文化考察到科技教育交流

2024-04-17 14:47

李建文 - 化悶象為創意|牆角寒梅

2024-04-17 12:32

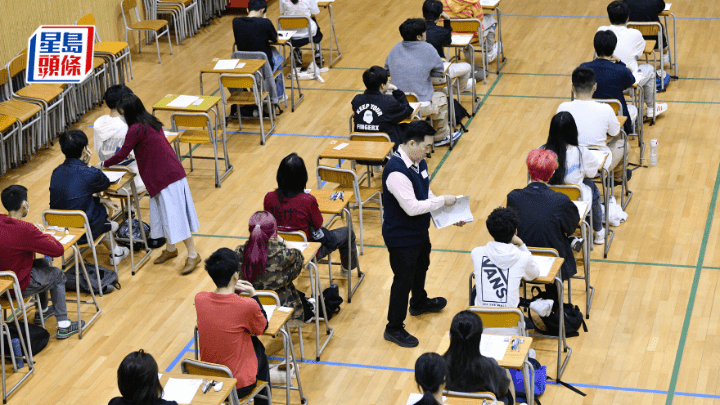

DSE 2024|「報到易」運作良好 8成考生自行簽到

2024-04-17 11:55

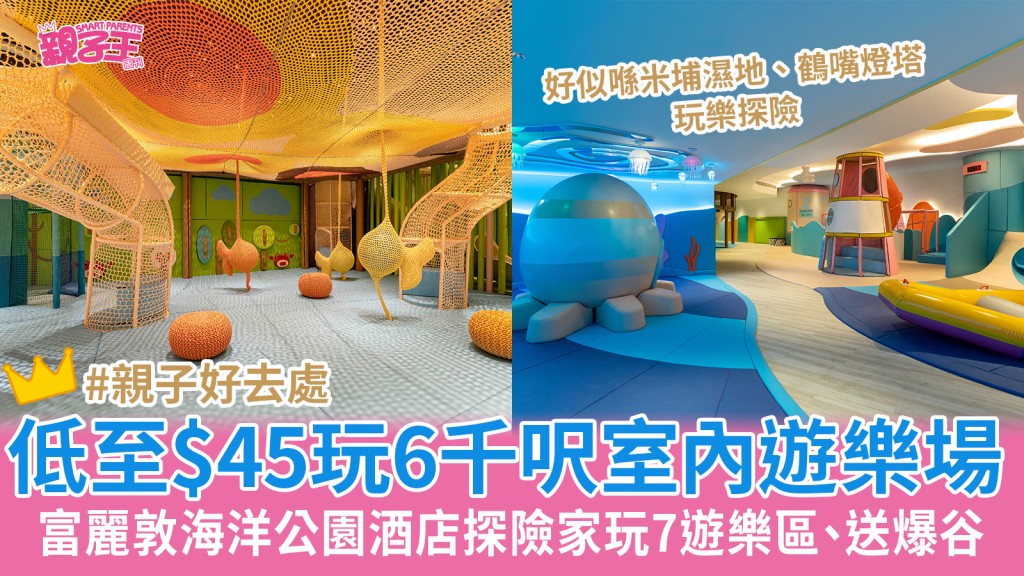

親子好去處2024︳富麗敦海洋公園酒店探險家低至$45玩6000呎室內遊樂場、再送爆谷!

2024-04-17 11:53

網傳監考員上載DSE答題簿 考評局:報警處理

2024-04-17 11:46

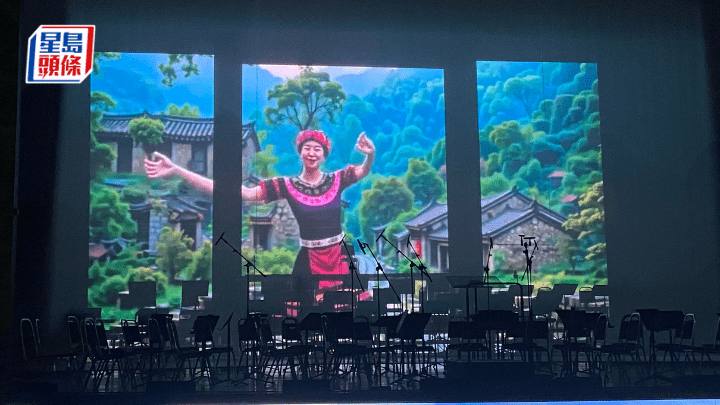

浸大音樂會 AI虛擬瑤族舞者登場 與真人同台演出 帶來沉浸式體驗

2024-04-17 11:37

八大儲備達1260億 港大371億最雄厚

2024-04-17 10:54