升中派位2024|即睇全港18區英中學額分布

2024-04-12 08:30

DSE開考懶人包2024|核心科/選修科精讀備戰攻略 + 解構扣分/DQ陷阱 + 惡劣天氣安排

2024-04-03 06:30

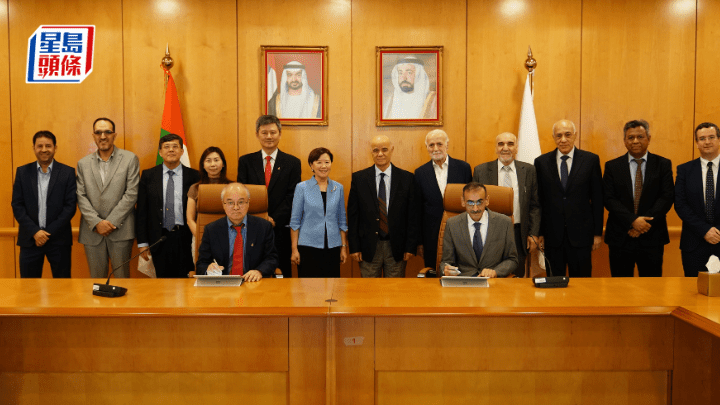

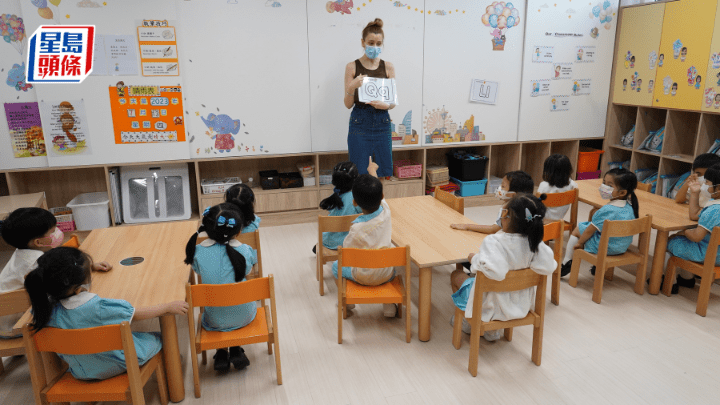

姊妹幼稚園交流計劃 粵港百校組「學習圈」

5小時前

中大調查:呈中度至嚴重抑鬱症狀中學生女多於男

18小時前

緊貼2024文憑試|分析中文卷一閱讀篇章(之一)

22小時前

快速乾鞋法︳落雨小朋友鞋襪易濕透一方法又平又吸濕!6招簡易乾鞋法+5大烘鞋器實測

2024-04-22 15:45

簡偉鴻 - 人盡其才 行行出狀元|津中樂道

2024-04-22 12:26

張騫——傑出探險家、旅行家和外交家|星島教室

2024-04-22 12:19

親子優惠︳沙田萬怡酒店自助餐買一送一低至$200任食生蠔 晚餐歎波士頓龍蝦/鵝肝、母親節用得

2024-04-22 12:00

宣明會-不一樣的「家」 走進索馬里蘭流徙者營地|放眼世界

2024-04-22 12:00

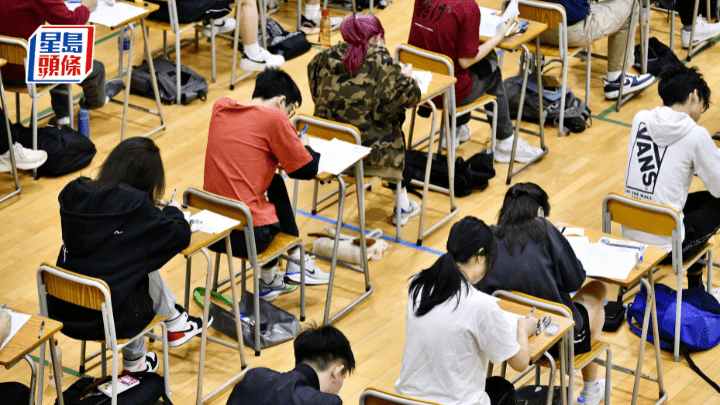

網上仍流傳DSE答題簿 考評局:密切監察情況

2024-04-22 11:09

專家推介10大益智遊戲及STEAM教具!附家長選擇與陪玩貼士提升孩子學習動機

2024-04-22 07:15