升中派位2024|即睇全港18區英中學額分布

2024-04-12 08:30

DSE開考懶人包2024|核心科/選修科精讀備戰攻略 + 解構扣分/DQ陷阱 + 惡劣天氣安排

2024-04-03 06:30

緊貼2024文憑試|分析中文卷一閱讀篇章(之二)

18小時前

凌婉君 - 製造成功對小孩的重要|家長教室

20小時前

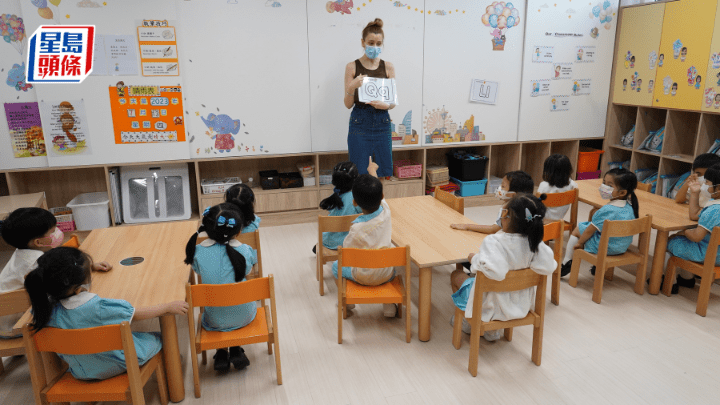

姊妹幼稚園交流計劃 粵港百校組「學習圈」

21小時前

學中文︳德萃國際幼兒園.幼稚園互動式繪本閱讀體驗 實踐所學強化能力

2024-04-23 07:15

中大調查:呈中度至嚴重抑鬱症狀中學生女多於男

2024-04-22 21:31

緊貼2024文憑試|分析中文卷一閱讀篇章(之一)

2024-04-22 18:14

親子旅遊2024︳中山美食一天團買一送一 低至$148品嚐石岐乳鴿/金獎脆肉鯇燒鵝宴/送行李箱

2024-04-22 18:03

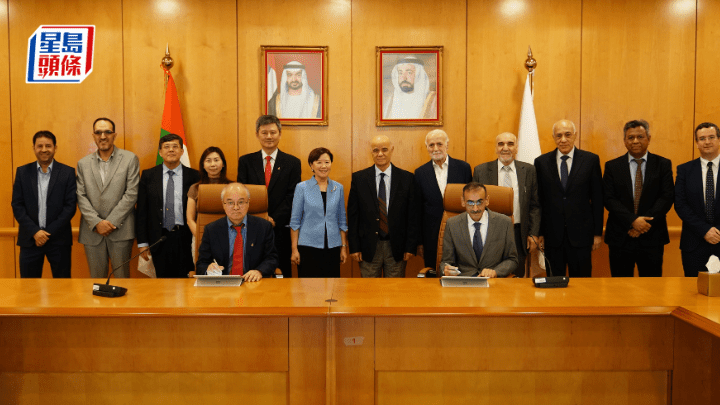

科大代表團訪問阿聯酋 與當地基金會、大學簽訂合作協議

2024-04-22 17:37

香港星島新聞集團聯合主辦 第二屆深港澳青少年創意設計大賽頒獎典禮於深圳圓滿舉行

2024-04-22 17:15

8港區高教界政協委員於港專分享兩會見聞 強調科技創新

2024-04-22 16:37

快速乾鞋法︳落雨小朋友鞋襪易濕透一方法又平又吸濕!6招簡易乾鞋法+5大烘鞋器實測

2024-04-22 15:45

簡偉鴻 - 人盡其才 行行出狀元|津中樂道

2024-04-22 12:26