JUPAS首輪改選5.29截止|即睇7個改選注意事項 + 6間院校課程諮詢日詳情 (附報名連結)

2024-05-07 06:30

健力士紀錄 創造世界之最|常識科學

15小時前

李建文 - 展現學生多元成就(上)|牆角寒梅

16小時前

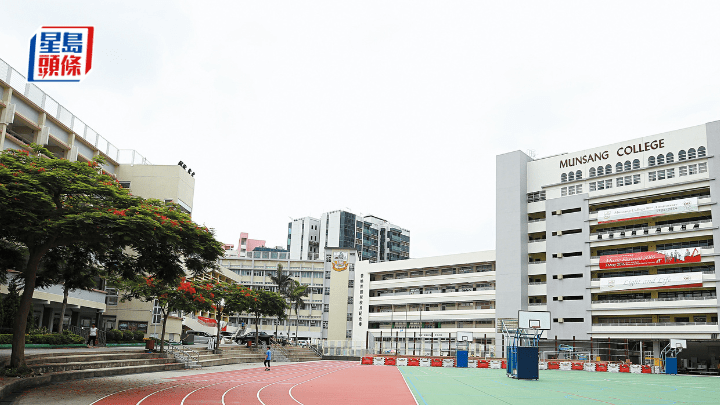

民生書院幼園加班 教局:校方須適切回應

18小時前

IB跨時區作弊|亞洲考生網上洩漏試題 歐洲考生試前任睇 逾4100人要求重考或取消考試

2024-05-08 00:00

曾肇弘 – 九龍城寨的污名與神話|曾幾何時

2024-05-07 19:14

小孩也有壓力?有這4個徵狀或壓力爆煲!家長必學3個方法助孩子解壓︳兒童心理

2024-05-07 17:47

親子旅遊︳珠海橫琴星樂度希爾頓花園酒店買一送一 低至$189位連自助早餐、星奇塔無動力世界門票

2024-05-07 17:23

「中學全港學界中國茶藝比賽」連續兩年全港稱冠 張沛松紀念中學 培養學生成為中華文化的代言人

2024-05-07 17:08

7-11優惠︳7-Eleven 8天限時優惠foodpanda滿指定金額即享8折 尊享折上折/再送蜜桃西柚烏龍茶

2024-05-07 16:42

蔡若蓮明率高等院校代表團訪京 拜訪港澳辦及國家教育部

2024-05-07 14:55

趣味學漢語|「戕」「戈」字形字義兵器相關 認識部首

2024-05-07 14:00

發展綠色科研 推動碳中和|研之有理

2024-05-07 12:56

理大生設計時裝為銀屑病患者說話 冀加強公眾認知 消弭歧視

2024-05-07 12:38